Once you have an active sales tax permit in Nebraska, you will need to begin filing sales tax returns. Not sure if you need a permit in Nebraska? No problem. Check out our blog, Do you Need to Get a Sales Tax Permit in Nebraska?

Also, If you would rather ask someone else to handle your Nebraska filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service . We specialize in eliminating the stress and hassle of sales tax.

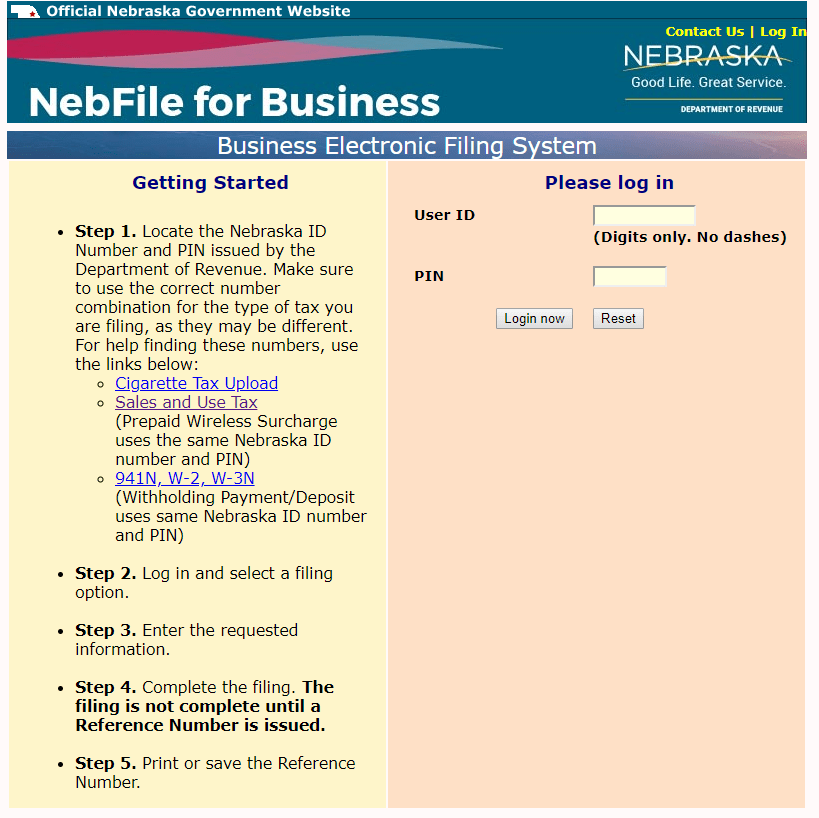

Step 1 : The first step in filing your Nebraska sales tax return is to log into https://ndr-efs.ne.gov/revefs/sctpublic/sctFormsViewAll.faces . You will use your Nebraska ID number and PIN issued by the Department of Revenue to login.

If you do not have a username and password, then your first step is getting that all setup. These login credentials are generally created when you submit registration paperwork for a sales tax permit.

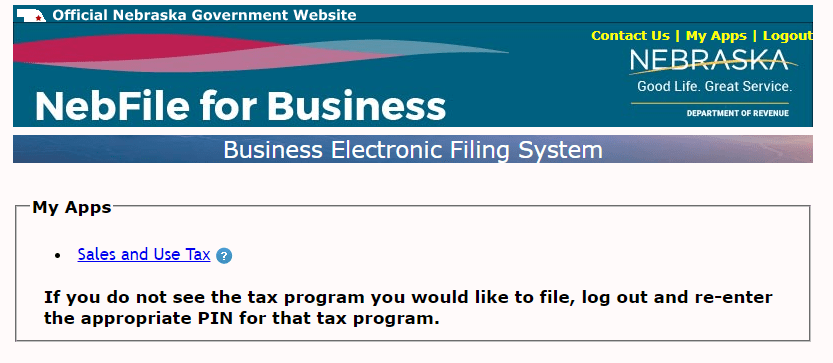

Step 2 : Select “ Sales and Use Tax ” to get started with your return.

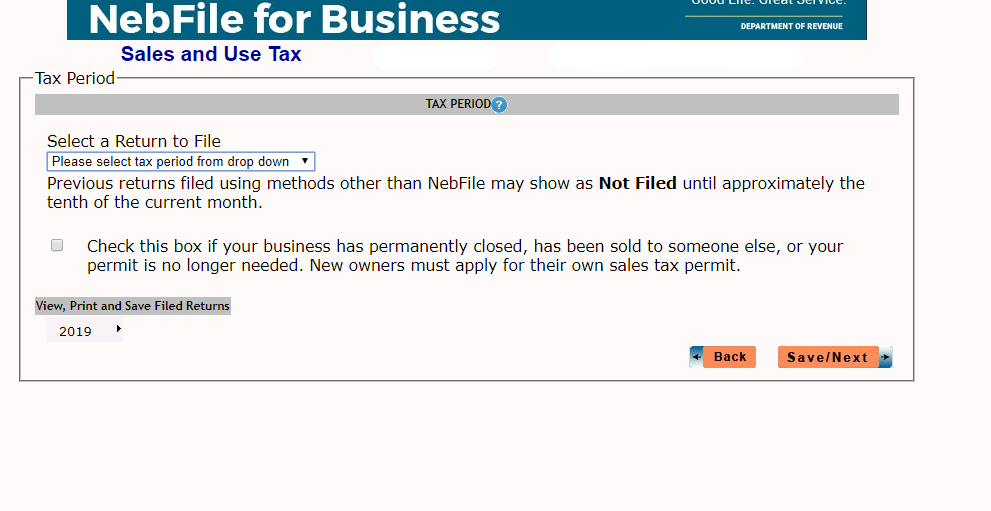

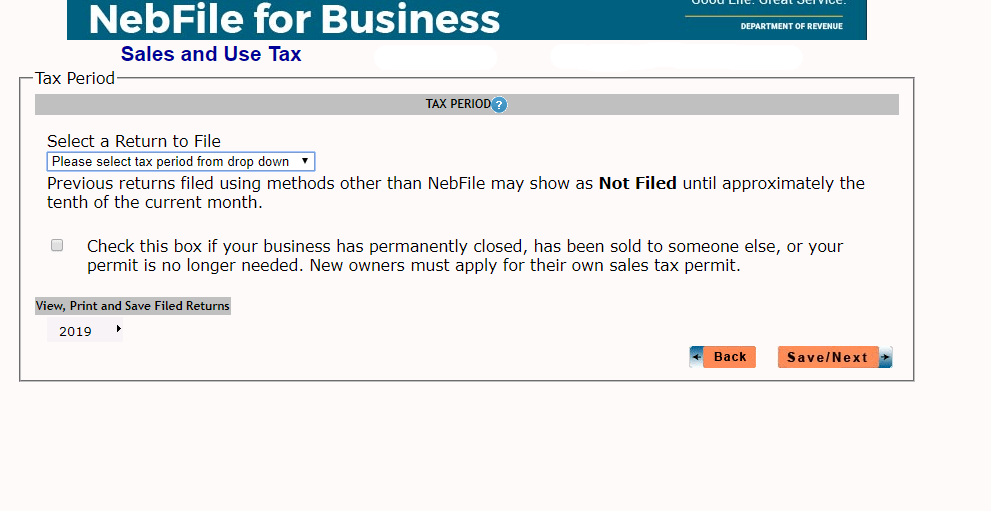

Step 3 : Select a return to file from the drop-down menu. If you are up-to-date with your sales tax filings, there should only be one listed. Then click “ Save/Next .”

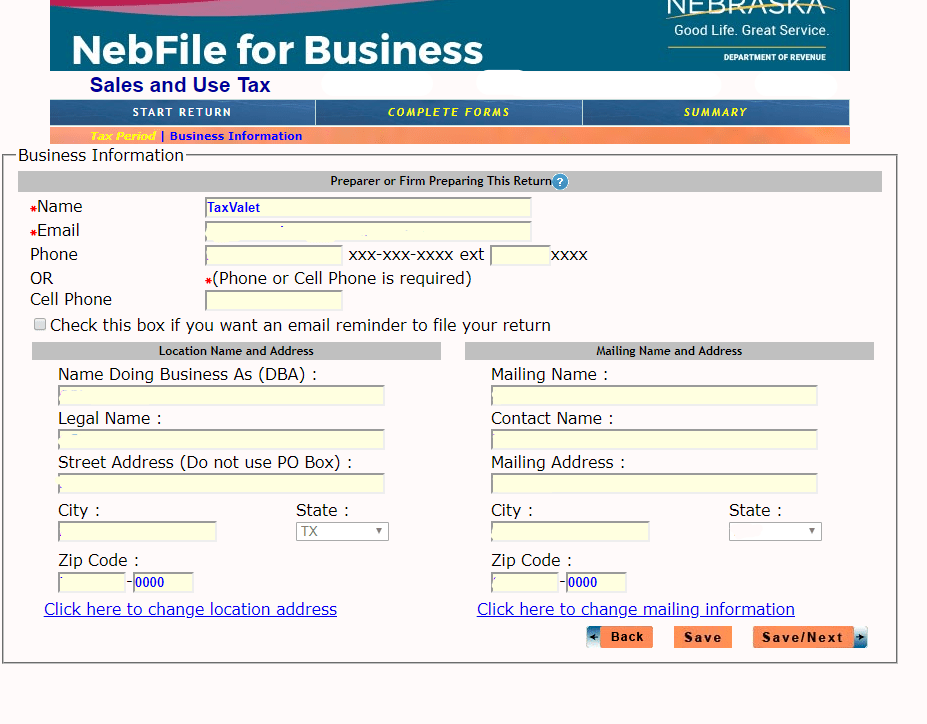

Step 4 : You will see a page with your business information. Make sure your information is correct and click “ Save/Next .”

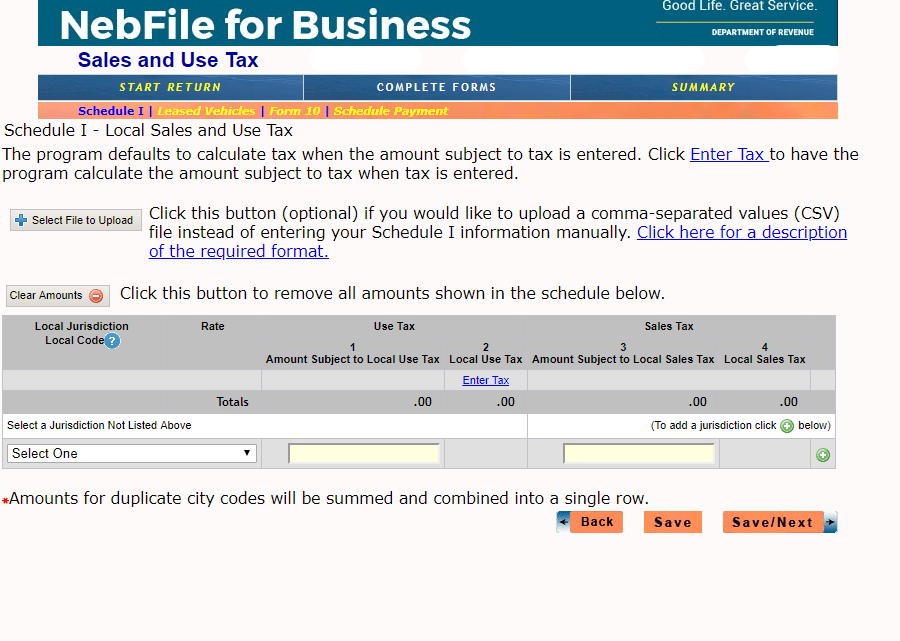

Step 5 : Enter your jurisdictions and amount of use and/or sales tax. Continue to add as many jurisdictions as you need. Note, if you sell via marketplace providers only, you may not have any jurisdictions to report. Then click “ Save/Next. ”

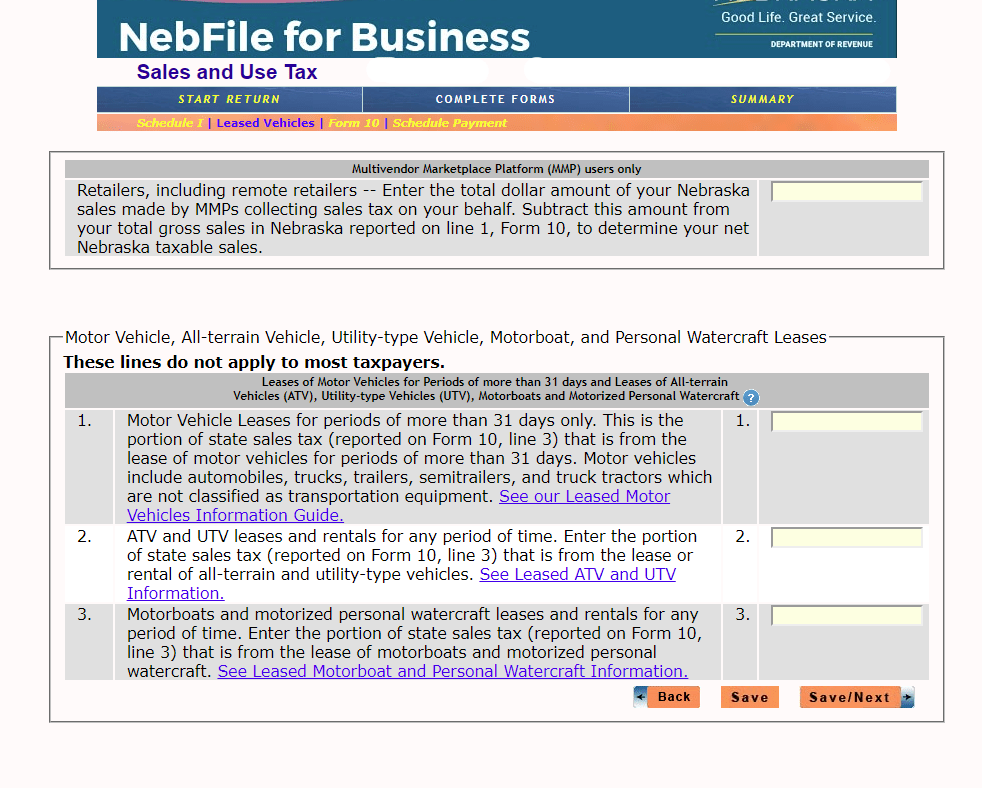

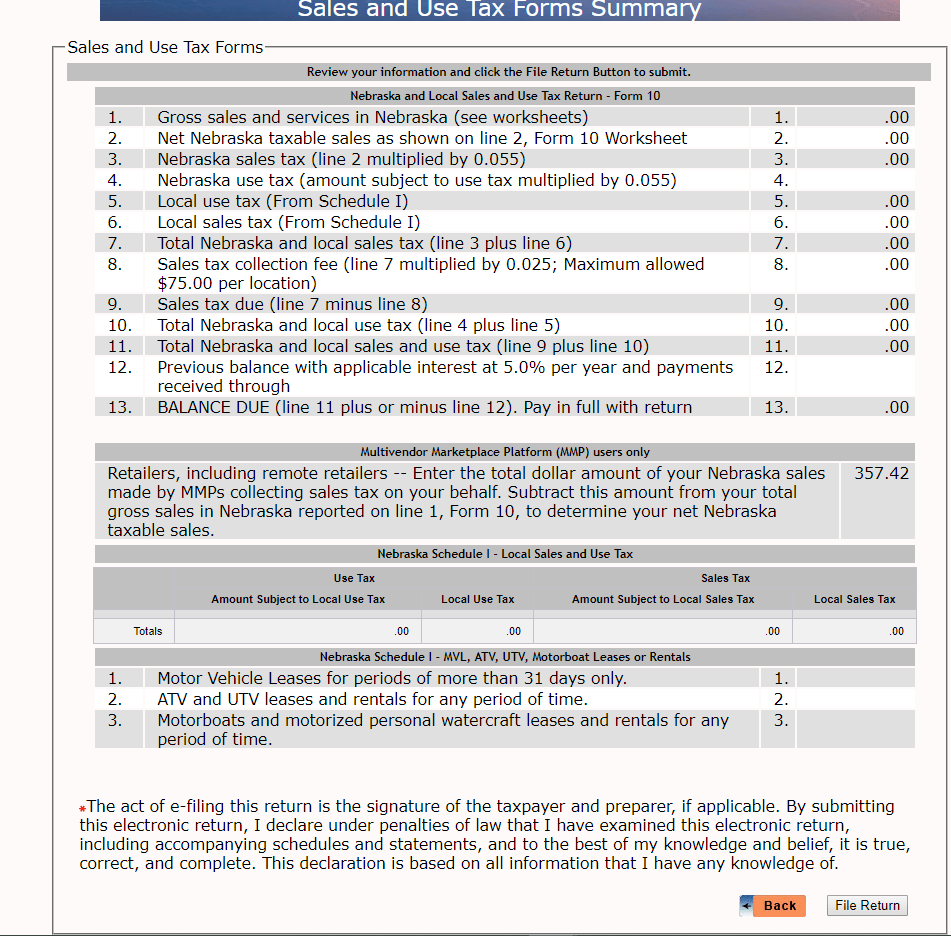

Step 6 : On this page enter any marketplace sales on the first line. You will end up subtracting marketplace sales from your gross sales on line 1 on “form 10.”

The next three lines do not apply to most taxpayers unless you sell motor vehicles.

Click “ Save/Next .”

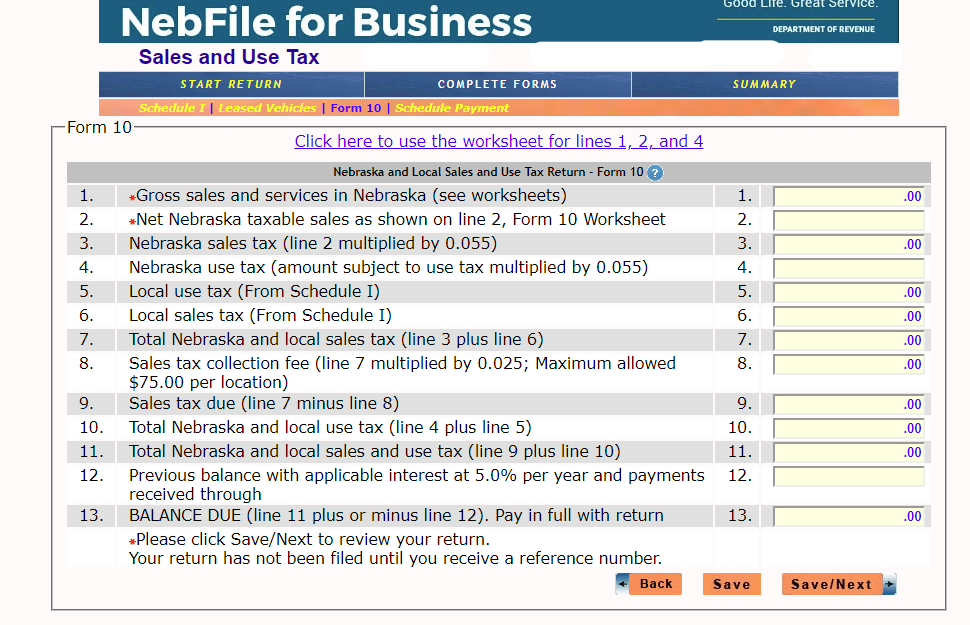

Step 7 : Enter your gross sales on line 1, remembering to subtract marketplace sales.

Enter all other requested sales tax information on the subsequent lines.

Nebraska offers a worksheet that you can use on this page. To find it, click the link titled, Click here to use the worksheet for lines 1, 2, and 4 .

Once you are done, just click “ Save/Next ”.

Step 8 : You are now ready for the final review of your return. If everything looks correct, click “ File Return ”. If you see any mistakes, be sure to go back and make changes. Once you click “ File Return ” you cannot make any changes.

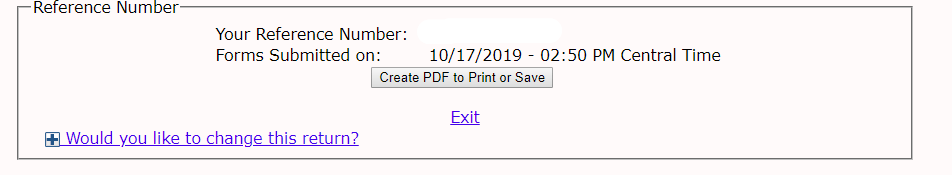

Hooray! You have now filed your return.

Step 9 : Make sure to save the confirmation number that comes up on the screen once the return has been submitted. We also recommend saving a copy of your return for your records.

To save or print a copy of the return, click “ Create PDF to Print or Save ” as seen below.

You are now ready to make your payment. If you need to make a payment without filing a return you will have to use Nebraska e-pay. Here is the link, https://revenue.nebraska.gov/businesses/nebraska-e-pay. The state withdraws funds from your bank account based on the information you provide. If this is your first time accessing the e-pay system, you must use your Nebraska ID number as well as your password. After your initial login, you will need to create an e-pay password. The e-pay password must be 8 to 16 characters and include at least one number and one letter. The e-pay system will guide you through the steps necessary to log in and maintain your account. If you use the tele-pay system (800-232-0057), you must use your Nebraska ID number as well as your password the first time you access it. After your initial access, you will need to create a tele-pay password. The tele-pay password must be 4 to 16 numeric characters. If you use both the e-pay system and the tele-pay system, the passwords you create for each method cannot be the same. Once your set-up is complete, click the “Make Payment” button to make your EFT debit payment. Do NOT use this link to make individual income tax payments.

If you forgot to print or save a copy of your sales tax return, you still can! Login again and choose “ Select Sales and Use Tax .” On the bottom left-hand side of the page you can “ View, Print and Save Filed Returns .”

If you are stuck or have questions, you can contact the state of Nebraska directly at (800) 742-7474. You can also find additional resources at the Nebraska Department of Revenue (DOR) website. If instead, you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service . Feel free to contact us if you’re interested in becoming a client!