- The Federal Government will pay interest on a subsidized loan while you are in school and during your six-month grace period

- Read more about the difference between subsidized and unsubsidized loans.

- If you accept the unsubsidized loan, interest will accrue while you are enrolled in school.

- If you choose not to pay the interest while you are in school and during grace periods/deferment periods, your interest will accrue (accumulate) and be capitalized (that is, your interest will be added to the principal amount of your loan).

- Read more about the difference between subsidized and unsubsidized loans.

- PLUS Loansare loans made to graduate students or parents of dependent undergraduate students to help pay for education expenses not covered by other financial aid. [View more]

- Parents of a dependent undergraduate student may apply for a Federal Direct PLUS loan to help meet the student’s cost of attendance not covered by other financial aid.

- Student must submit a FAFSA. Parents must complete a PLUS Loan application at StudentAid.gov.

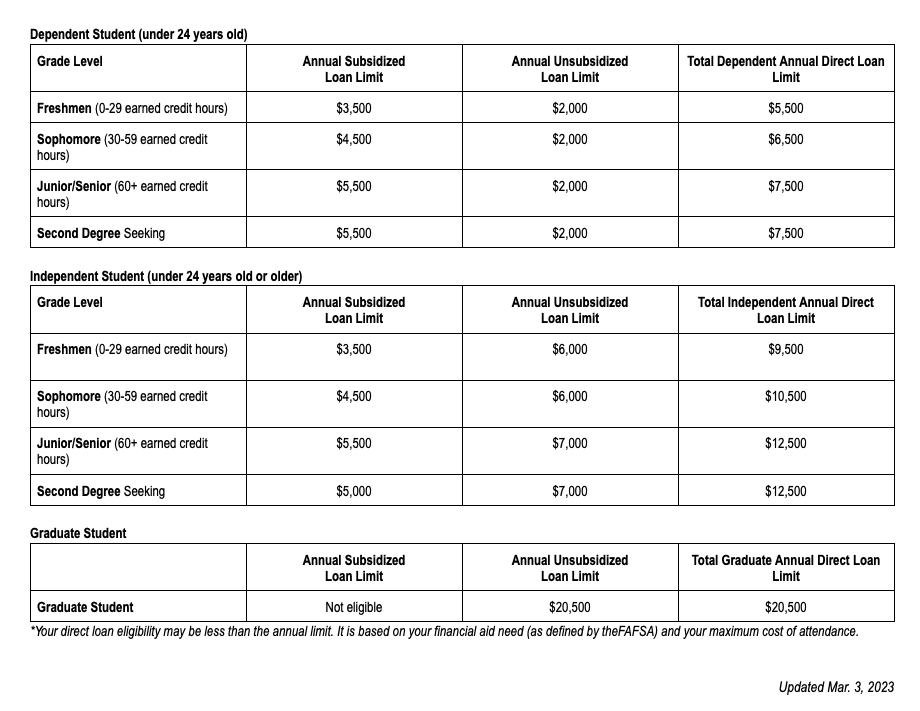

Annual Direct Loan Limits

[click chart to enlarge]

Independent students and students whose parents were denied for a PLUS loan are eligible for additional funding through the Federal Unsubsidized Direct Loan program.

Direct Loan Interest Rates

Current interest rates** on all Federal Direct Loans are fixed. Undergraduates receive different interest rates for subsidized and unsubsidized loans; rates for grad students are the same whether the loan is subsidized or unsubsidized.

Undergraduates

- Subsidized – 5.50%

- Unsubsidized – 5.50%

Graduates

- Unsubsidized – 7.05%

PLUS Loans

- Parent PLUS – 8.05%

**Interest rates for loans first disbursed on or after July 1, 2023 and before July 1, 2024

Direct Loan Origination Fees

An origination fee is charged by the Federal Government for Direct Loans. This fee is a percentage of the total loan amount and is deducted from each loan disbursement. You are responsible for repaying the entire amount you borrow.

- Direct Subsidized & Unsubsidized Loans

- Loan fee = 1.057% (First disbursement date on or after 10/1/20 and before 10/1/23)

- Example: $58.13 on a $5,500 loan

- Example: $58.24 on a $5,500 loan

- Loan fee = 4.228% (First disbursement date on or after 10/1/20 and before 10/1/23)

- Example: $422.80 on a $10,000 loan

- Example: $423.60 on a $10,000 loan

Alternative Loans

Lenders are Private

- Private education loans in the student’s name that help bridge the gap between the actual cost of your education and the amount the government allows you to borrow in its programs.

- Students will need to apply directly with the lender of their choice. Most students will be required to have someone co-sign the loan application.

- Interest rates for loans are determined by the lender

- View this online resource: ELM Select

Graduate Loan Information

Graduate students borrowing loans should view additional information here to learn more about their loan resources.

- Loan fee = 1.057% (First disbursement date on or after 10/1/20 and before 10/1/23)